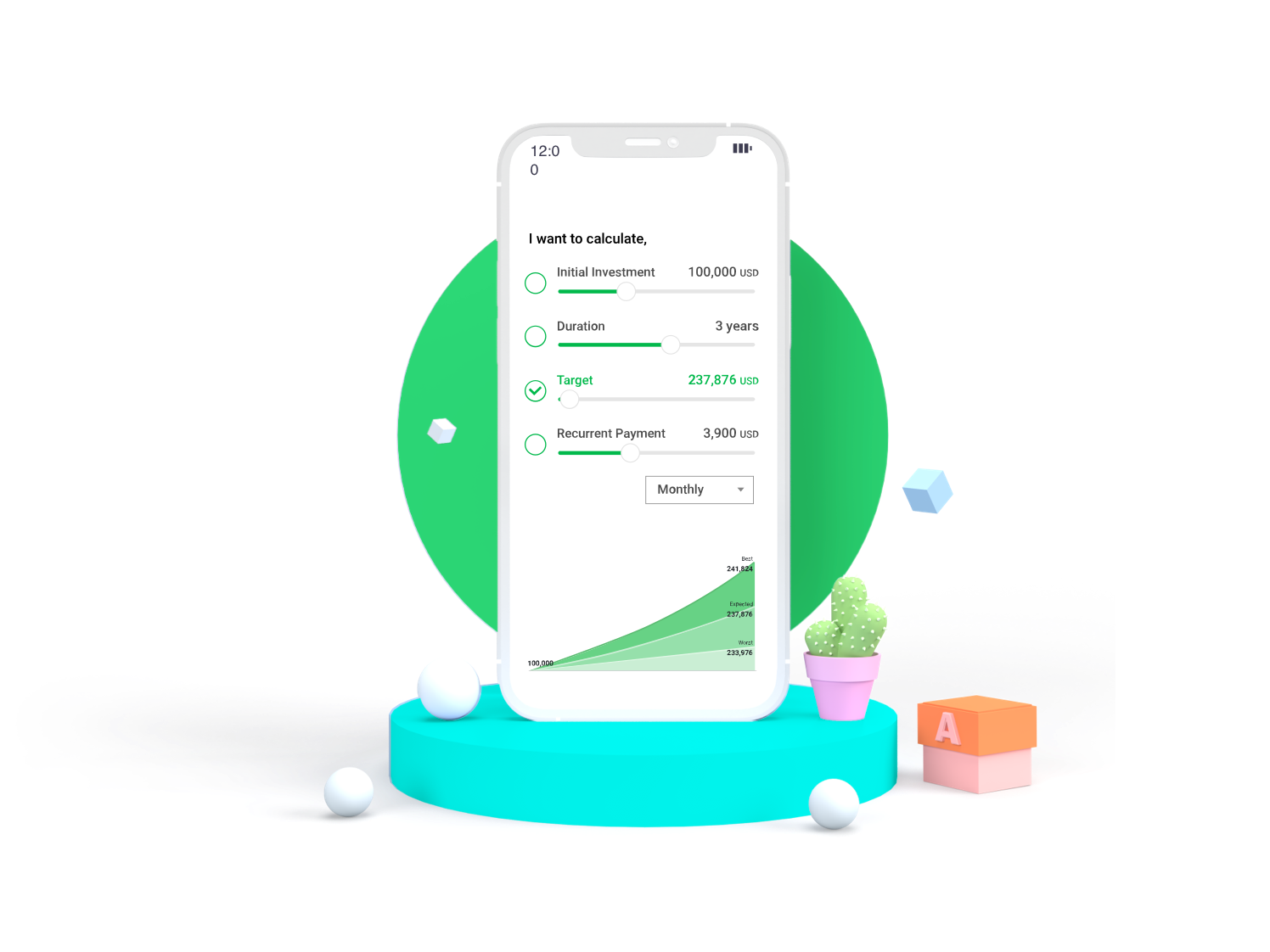

Calculate Your Cost Of Investment

How to calculate the fees?

What are the fees I should pay to run a portfolio through Du Invest?

Du Invest charges one type of fees.

Management fee: from 0.45 % to 0.99% per year of the total portfolio, depending on your portfolio size. Calculated daily, to be deducted monthly.

Would you please give me an example how I can calculate the management fees?

Management fee: from 0.45% to 0.99% per year of the total portfolio, depending on your portfolio size. Calculated daily, to be deducted monthly.

Example:

Portfolio: 10,000 EGP

Fee: 1% per year

Calculation = 10,000 x 1% = 100EGP (calculated daily and deducted monthly) it means about 8 EGP per month.

What should I benefit from paying these fees?

• Rebalancing your portfolio according to market directions and best asset allocation.

• Buying & selling investment instruments on behalf of you, Mutual funds, stocks, T-bills, t-bonds, CDs.

• Providing periodic performance report.

• Account on our system to monitor or control your investments.

• Providing different products that you can invest in. Such as, Growth portfolios, or investment/pension, wedding & education plans that can benefit you during your retirement or any goal you might need.

• And most importantly, invest your portfolio like professionals.

• One-on-one wealth advice.